The New York Free Trade Zone is commonly associated with international trade, but its impact extends beyond logistics and customs—especially in the insurance industry. Businesses operating within this zone must consider how insurance requirements, coverage options, and risk factors change when conducting business in these designated areas.

Understanding the New York Free Trade Zone

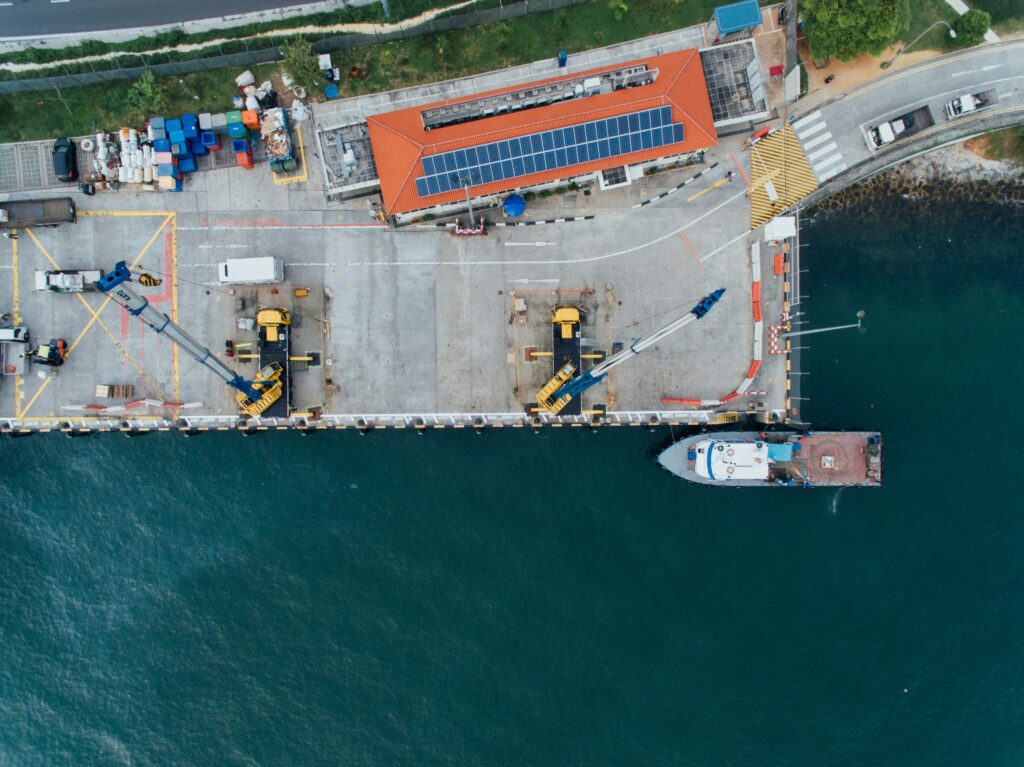

The New York Free Trade Zone is a designated area that allows businesses to import, store, and manufacture goods with reduced or deferred customs duties. While this provides economic benefits, it also presents unique insurance challenges that companies must navigate.

Insurance Considerations in FTZs

Operating in a Free Trade Zone requires businesses to assess their insurance needs carefully. Standard insurance policies may not fully cover risks associated with FTZ operations. Here are key areas where insurance differs within these zones:

Property Insurance for FTZ Operations

Goods stored in the zone may require specialized insurance policies. Standard property insurance may not cover losses due to customs-related issues, foreign ownership structures, or specific FTZ regulations. Companies should ensure their policies explicitly cover goods within these areas.Liability Coverage in FTZs

Businesses in the New York Free Trade Zone may face different liability exposures. Importers, manufacturers, and logistics providers must consider additional liability insurance to protect against claims related to cargo damage, regulatory fines, or operational risks.Business Interruption Insurance

Companies in FTZs may experience delays due to customs processing, regulatory changes, or supply chain disruptions. Business interruption insurance tailored to FTZ-specific risks can help mitigate financial losses when operations are halted unexpectedly.Marine Cargo Insurance for FTZ Imports

Since the New York Free Trade Zone allows businesses to defer duties until goods enter U.S. commerce, marine cargo insurance is crucial. Coverage should extend to goods stored in FTZs to protect against theft, damage, or transit-related risks.Compliance and Regulatory Insurance

Companies in FTZs must comply with customs regulations and government policies. Non-compliance could result in fines or legal actions. Businesses should explore policies that provide coverage for legal expenses and regulatory compliance support.

How to Choose the Right Insurance for FTZ Operations

Selecting the right insurance for businesses in FTZs involves working with providers familiar with zone regulations. Companies should:

- Review existing policies to ensure FTZ-specific risks are covered.

- Consult with insurance brokers who specialize in FTZ operations.

- Consider additional endorsements or riders for comprehensive protection.

Final Thoughts

The New York Free Trade Zone offers significant economic benefits, but businesses must proactively manage their insurance needs to mitigate risks. Whether dealing with property protection, liability coverage, or business interruption insurance, securing the right policies ensures smooth operations in the FTZ environment.

Navigating FTZ regulations and ensuring proper insurance coverage can be complex, but you don’t have to do it alone. Simple Forwarding, a trusted New York-based freight forwarder and customs broker, can guide you through leveraging these zones to optimize your supply chain. From customs compliance to freight forwarding solutions, our expert team is here to help. Contact us today to streamline your operations and maximize your FTZ benefits.