New York Free Trade Zone Classes (FTZ Classes) offer businesses a strategic advantage by allowing duty deferral, tariff reductions, and streamlined customs processes. However, not all classes and types of FTZs operate the same way—different classes define how businesses can utilize these zones. Understanding these classifications is essential for importers, manufacturers, and logistics providers looking to maximize the benefits.

What Are Free Trade Zones?

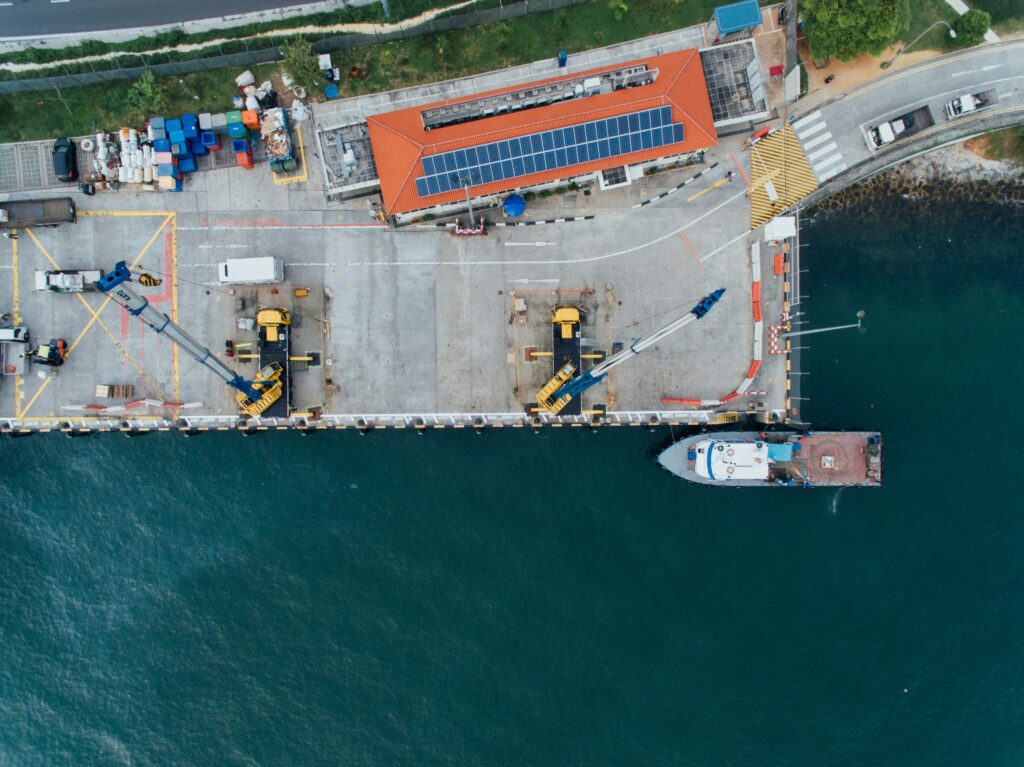

These are designated areas where businesses can store, manufacture, or process goods with reduced or deferred customs duties. These zones are particularly useful for companies engaged in international trade, providing cost savings and supply chain efficiencies.

Classes of Free Trade Zones

There are several categories, each based on usage and operational structure. The main classifications include:

1. General-Purpose Free Trade Zones

These zones are designed for multiple users and are typically located in industrial parks or port areas. Businesses in these zones can warehouse, store, and distribute imported goods without immediately paying duties. They are ideal for:

- Distribution centers

- E-commerce fulfillment

- Light manufacturing and assembly operations

2. Special-Purpose Subzones

When a company’s operations do not fit within a general-purpose FTZ, they may apply for a special-purpose subzone designation. These subzones are usually located at the company’s existing facility and provide tailored benefits, such as:

- Duty deferral on imported raw materials for manufacturing

- Exemption from certain import/export quotas

- Reduced processing time for customs clearance

3. Manufacturing Zones

Some New York Free Trade Zone Classes allow for manufacturing activities, enabling companies to import raw materials, assemble products, and then export finished goods without paying duties. If the final product is sold within the U.S., companies may pay lower duty rates based on the finished product rather than the raw materials.

4. Bonded Warehouses vs. Free Trade Zones

While not an FTZ classification, many businesses compare bonded warehouses to FTZs. The key difference is that goods stored in bonded warehouses must pay duties before release into U.S. commerce, whereas New York Free Trade Zone Classes allow for duty deferral until the goods leave the zone.

Benefits of Using New York Free Trade Zone Classes

Businesses operating out of FTZ’s can enjoy several advantages, including:

- Cost Savings: Defer or reduce import duties and taxes.

- Improved Cash Flow: Duties are only paid when goods enter U.S. commerce.

- Regulatory Flexibility: Reduced paperwork and faster customs processing.

- Global Competitiveness: Ability to source raw materials at lower costs.

How to Apply for FTZ Status

To operate within New York Free Trade Zone Classes, businesses must:

- Identify the appropriate FTZ classification based on their operations.

- Submit an application to the Foreign-Trade Zones Board.

- Work with U.S. Customs and Border Protection (CBP) to ensure compliance.

Final Thoughts

Understanding New York Free Trade Zone Classes can help businesses optimize their import and export strategies. Whether utilizing a general-purpose zone for warehousing or applying for a manufacturing subzone, companies can unlock significant cost savings and operational efficiencies.

Navigating FTZ regulations can be complex, but you don’t have to do it alone. Simple Forwarding, a trusted New York-based freight forwarder and customs broker, can guide you through leveraging FTZs to optimize your supply chain. From customs compliance to freight forwarding solutions, our expert team is here to help. Contact us today to streamline your operations and maximize your FTZ benefits.